MEETING WITH FERNANDO COELHO FILHO, MINISTER OF MINES AND ENERGY, NOVEMBER 15, 2017

SPECIAL COCKTAIL RECEPTION WITH CEO OF AVIANCA BRAZIL, NOVEMBER 16, 2017

Brazilian American Chamber of Commerce, INC, received in the last november 16, 2017 , Frederico Pedreira, that is executive Vice-President responsible for operations and finance, will take over as CEO of the airline as from today. José Efromovich, co-founder and leader of the company since 2008, will be chairman of the Board of Directors.

Avianca Brazil has operated regular flights since 2002. The company currently operates at 23 airports in Brazil and one airport abroad, with some 220 daily departures. In 2015, it carried 8.5 million passengers with a standardized fleet that includes 41 Airbus aircraft.

#sulacostainternationalcorrespondent #avianca #NYC #Brazil #costaconsultingco #Brazilcham

Décio Oddone, Director General, ANP - Agência Nacional do Petróleo, Gás Natural e Biocombustíveis.

#costaconsultingco #NYC #brazilcham#sulacostainternationalcorrespondent #pre-salt #petroleum

AFTERNOON ROUNDTABLE DISCUSSION WITH DÉCIO ODDONE, DIRECTOR GENERAL, ANP, NOVEMBER 17, 2017

Décio Oddone, Director General, ANP - Agência Nacional do Petróleo, Gás Natural e Biocombustíveis.

#costaconsultingco #NYC #brazilcham#sulacostainternationalcorrespondent #pre-salt #petroleum

THEATER

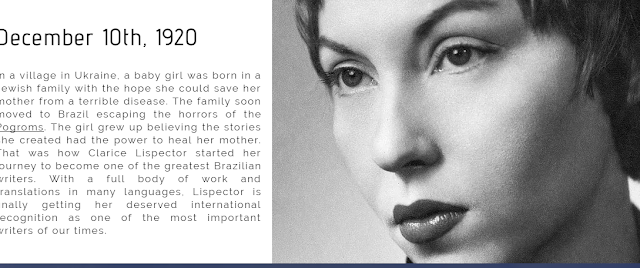

Clarice’s Hour, a celebration of Clarice’s Birthday by Group.BR

Clarice’s Hour, a celebration of Clarice’s Birthday by Group.BR

DEC 10 @ 5:00 PM – 8:00 PM

MUSIC

OBACH (Orquestra de Brasília) honors José Maurício Nunes Garcia .

OBACH (Orquestra de Brasília) honors José Maurício Nunes Garcia .

DEC 12 - 13 - Dimenna Center

SEMINAR ON IMPACT INVESTING

Join Us on December 12, 2017

impact investing can be defined simply as investments "made into companies, organizations, and funds with the intention to generate a measurable, beneficial social or environmental impact alongside a financial return." But such a simple definition still leaves many unanswered questions, even more so when applied to Brazil.

A diverse and distinguished panel, representing bilateral institutions, NGO’s, asset managers, and entrepreneurs explore key questions surrounding impact investing in Brazil:

- What role does impact investing play in social development? How impactful is it currently, and what is the expectation over time? How are impacts being measured?

- What are the roles of bilateral institutions, foreign and domestic NGOs and traditional or new asset management firms in Brazilian impact investing?

- What is the role of the Brazilian government in the process, how can it do more to promote impact investing? Could regulations be improved to increase the volume of impact investments?

- Who is actually providing the funds for impactful investing? Family offices? Foundations? Foreign governments? Private sector funds? Does debt play a role, or only equity?

- What are the principal criteria and what is the process behind identifying impact investments? Can investments be differentiated between philanthropy, venture capital, and private equity? Are there other meaningful categories?

- Can investors who are looking to make a positive difference with their investments really expect to also enjoy market returns? What are the vehicles for doing so, both at the institutional and individual level?

- Who and what ype of funds are involved in impact investing? Do they have external ratings? As an individual where can I go to make Impact Investments?

We will address these and other questions with the following panelists:

Moderator:

Mary Rose Brusewitz, Partner, Strasburg and Price LLC

Mary Rose Brusewitz, Partner, Strasburg and Price LLC

Panelists:

Fabio Jose Fagundes, Head of Financial Products, Investment Operations, IADB

Leonardo Letelier, Founder and CEO, Sitawi

Daniel Izzo, Partner and Executive Director, Vox Capital

Genevieve Edens, Impact and Research Director, Aspen Network of Development Entrepreneurs, The Aspen Institute

Fabio Jose Fagundes, Head of Financial Products, Investment Operations, IADB

Leonardo Letelier, Founder and CEO, Sitawi

Daniel Izzo, Partner and Executive Director, Vox Capital

Genevieve Edens, Impact and Research Director, Aspen Network of Development Entrepreneurs, The Aspen Institute

Venue to be announced!

No comments:

Post a Comment