Mixed Economic Data, Tensions With Iran

Overview: Mortgage rates have held relatively steady so far in 2020, a result of two offsetting influences: increased tensions with Iran, which were modestly favorable for mortgage rates, and the net effect of mixed economic data, which was slightly negative.

While the trade negotiations between the U.S. and China dominated international economic news in 2019, a new potential source of concern unexpectedly captured the spotlight over the past week. On Friday, the U.S. launched a drone strike that killed a top Iranian military commander. In apparent retaliation, Iran then launched missiles at an Iraqi airbase hosting American troops on Tuesday night. Investors responded by shifting to safer assets such as bonds while they watch to see if the situation will escalate further, but the impact has been relatively small so far.

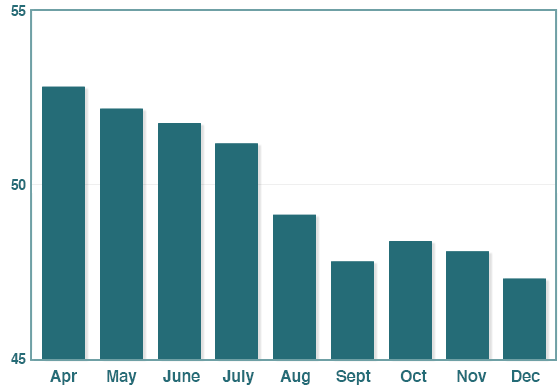

The two biggest economic reports released over the past week came from the Institute of Supply Management (ISM) and contained mixed results. The ISM Services Index, which covers the bulk of U.S. economic activity, increased more than expected to 55, which was the highest level since August. By contrast, the ISM Manufacturing Index declined more than expected to 47.2, which was the worst reading since June 2009. Readings above 50 signal an expansion, while those below 50 indicate a contraction. The manufacturing sector has been suffering for many months from trade restrictions imposed by the U.S. and China.

ISM Manufacturing Index

Friday, January 10 — Employment Report

Tuesday, January 14 — Consumer Price Index (CPI)

Thursday, January 16 — Retail Sales report

No comments:

Post a Comment